First to Profit from Tech Booms: Not the Inventors

Inventors create new technologies, but they seldom enjoy the initial profits that come with them. The early profits typically go to those who connect innovation with market needs, utilizing resources, networks, and contextual insights to convert unrefined technology into real value—particularly for those equipped to enhance these relationships. This disparity stems not from chance; it arises from the purposeful conversion of inventiveness into valuable, actionable solutions.

Ecosystem Designers of Worth

Inventors prioritize technical viability, whereas designers construct the environments that render technology lucrative. A startup might come up with revolutionary augmented reality mapping technology, yet luxury travel planners who incorporate it into exclusive safari adventures or visits to historic estates are the first to profit. They combine the innovation with premium experiences, developing exclusive packages that yield much higher returns than the fees paid to the inventor.

Emerging technologies often do not have clear applications—interpreters transform them into something sought after by discerning users. An inventor of AI biometrics may struggle with scaling, but a luxury wellness company that incorporates the technology into customized anti-aging regimens quickly finds success. By marrying the innovation with unmet desires of the elite (subtle, data-informed health enhancement), they convert novelty into an essential service.

Risk-Reducing Early Adopters

Inventors take on research and development risks, but intelligent adopters with financial security can turn the flaws of prototypes into profitability. A blockchain supply-chain technology developer encounters difficulties in gaining traction, whereas an upscale jewelry firm employs the unfinished tool to authenticate rare stones. They bear the expense of fine-tuning the technology and then promote “verified provenance” as a distinctive selling feature, capturing the benefits of early adoption.

Network Controllers of Entrance

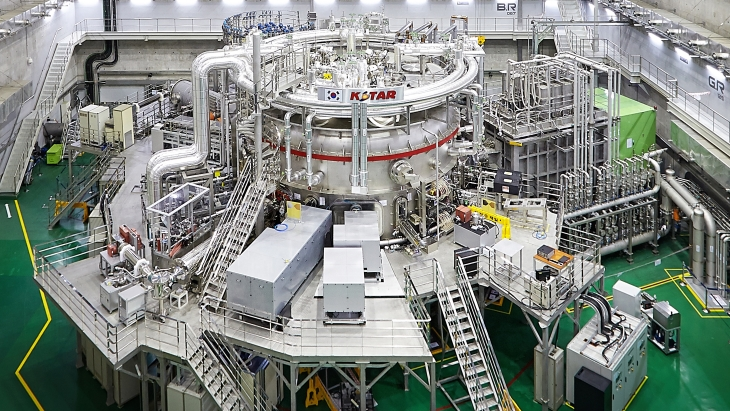

Access drives profit, and controllers manage who can utilize new technologies initially. A quantum computing creator looks for collaborators, while an exclusive investment club that secures early access can provide “quantum-enhanced portfolio insights” to its members. They capitalize on access, transforming the invention into an exclusive membership benefit that generates subscriptions and fees.

Integrators embed new technology into lasting assets, forming continuous revenue streams that inventors overlook. An AI content creation inventor licenses their technology, but a family office that utilizes it to create digital archives of historical assets (art, family narratives) benefits by safeguarding and monetizing heritage. The technology becomes a means of appreciating assets instead of merely a standalone item.

Issue Resolution Beyond Invention

Inventors often seek “exciting” technology, while problem solvers address related challenges. A startup develops extremely fast wireless charging, but a luxury yacht manufacturer that incorporates it into custom ships resolves a significant issue (powering devices onboard during remote travels). They command a premium for their integrated solution, reaping profits from the inventor’s technology while overcoming a niche, high-value challenge.

The initial profits generated by technological advancements reward interpreters, designers, and integrators rather than solely inventors. For discerning clients, this implies that the route to early success involves looking beyond the technology itself, focusing on aligning it with existing demands, networks, and assets to seize value before mainstream markets become aware.

(Writer:Lorik)