Fusion Supply Chain Boom: Critical Materials and Global Collaboration

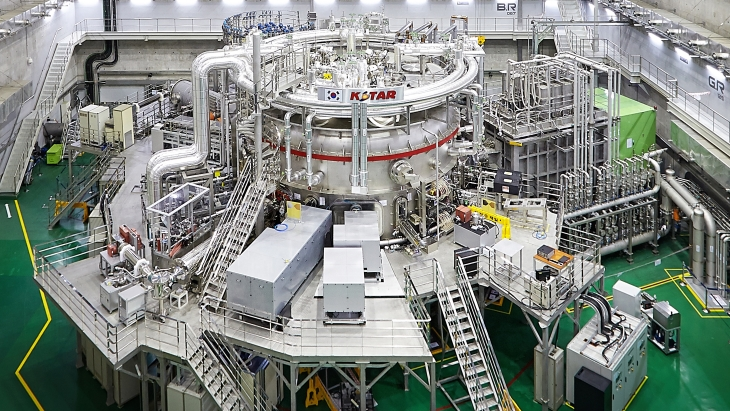

2025 has seen a seismic surge in the fusion energy supply chain, driven by the sector’s shift from experimental to commercial readiness. With Alphabet’s 200-megawatt (MW) fusion power deal and China’s BEST tokamak breakthroughs validating fusion’s viability, demand for critical materials—from superconducting coils to fusion fuels—has skyrocketed. This boom isn’t just a industrial trend; it’s a global race to build the infrastructure that will turn fusion into a mainstream clean energy source, requiring unprecedented collaboration across borders, industries, and research labs.

At the heart of this supply chain expansion are three high-demand materials, each with unique challenges. First, superconducting materials—essential for containing the ultra-hot plasma in tokamaks—are facing a capacity crunch. Niobium-titanium (NbTi), the workhorse for low-temperature superconducting coils (used in BEST and ITER), is currently produced by only four firms globally. To meet demand, Germany’s BASF announced a fifty million United States dollars investment in a new NbTi plant in Poland, set to open in 2026 and triple global output. For high-temperature superconductors (HTSs) like yttrium barium copper oxide (YBCO)—key for smaller, more efficient fusion reactors—U.S. startup Superconductor Technologies partnered with Japan’s Sumitomo Electric in July 2025 to scale production, aiming to cut YBCO costs by 40% by 2027.

Second, fusion fuels—deuterium and tritium—are critical for power generation, and supply chains are racing to keep up. Deuterium, extracted from seawater, is abundant, but tritium (which decays rapidly) must be produced in reactors. Canada’s CANDU Energy launched a twenty million United States dollars project in June 2025 to build the world’s first commercial tritium extraction facility, targeting 200 grams of tritium per year by 2028—enough to power a 50MW fusion plant. Meanwhile, the European Union’s Fusion Fuel Consortium is investing thirty million United States dollars to develop “tritium breeding blankets” (materials that produce tritium inside fusion reactors), a technology deemed essential for long-term fuel self-sufficiency.

Third, high-temperature resistant materials—like tungsten alloys for reactor walls—are in short supply. Tungsten can withstand the 150-million-degree Celsius plasma in tokamaks, but only 80% of global tungsten production meets fusion-grade purity standards. In response, China’s Baowu Steel (the world’s largest steelmaker) partnered with U.S.-based Commonwealth Fusion Systems in August 2025 to build a tungsten processing plant in Australia, increasing fusion-grade tungsten supply by 25% when operational in 2027.

Global collaboration is proving vital to overcoming these bottlenecks. The International Fusion Supply Chain Alliance (IFSCA), launched in May 2025 by 12 countries (including the U.S., China, Germany, and Japan), aims to standardize material specifications and share production capacity data. For example, ITER—the world’s largest fusion experiment—now sources NbTi from BASF (Germany) and Sumitomo (Japan), while its tungsten walls come from Baowu (China) and Sweden’s Sandvik. This cross-border coordination has cut ITER’s material delivery delays by 30% compared to 2024.

Challenges remain, however. Geopolitical tensions could disrupt supply lines: 70% of global yttrium (a key component of YBCO) comes from China, prompting the U.S. Department of Energy to fund domestic yttrium mining projects. Additionally, material costs remain high—fusion-grade tungsten currently costs eight hundred United States dollars per kilogram, five times more than industrial-grade tungsten. But innovations like 3D-printed tungsten components (being tested by Germany’s Max Planck Institute) could reduce costs by 50% by 2029.

As 2025 unfolds, the fusion supply chain boom is more than just industrial growth—it’s a test of global cooperation. Without unified efforts to scale materials production and share technology, fusion’s promise of clean, limitless energy risks being delayed. For a world racing to decarbonize, this supply chain isn’t just about materials—it’s about building the foundation of a sustainable energy future. In this race, collaboration isn’t an option; it’s the only way to turn fusion from a dream into a daily reality.

(Writer:Laurro)