Global mRNA Cancer Vaccine Race: Everest's EVM14 and Russia's Personalized Therapy

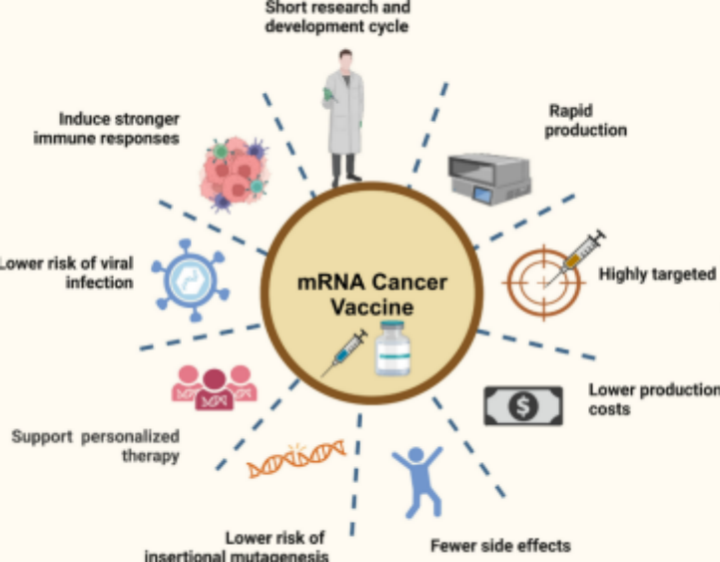

2025 has emerged as a pivotal year in the global race to develop mRNA-based cancer vaccines, with two breakthroughs—U.S.-based Everest Therapeutics’ EVM14 and Russia’s personalized neoantigen therapy—redefining how researchers target hard-to-treat tumors. Unlike COVID-19 mRNA vaccines that target a single viral protein, these cancer-focused candidates tackle the genetic complexity of tumors, marking a shift from “one-size-fits-all” to precision oncology. As clinical data pours in, the competition highlights how regional innovation is shaping the next era of cancer treatment.

Everest’s EVM14, unveiled in March 2025, focuses on solid tumors—a category that accounts for 90% of cancer cases—with an initial focus on melanoma and pancreatic cancer. The vaccine uses a multi-antigen design, targeting four key neoantigens (mutated proteins unique to tumors) instead of just one, reducing the risk of tumor escape. In phase II trials completed in June 2025, EVM14 combined with a PD-1 inhibitor showed a 42% objective response rate (ORR) in advanced melanoma patients, compared to 28% for the inhibitor alone. Notably, the vaccine demonstrated durability: 78% of responders maintained tumor control for over six months. Everest attributes this success to its proprietary “mRNA stabilization platform,” which extends the vaccine’s half-life in the body by 30% compared to earlier mRNA cancer candidates. The company secured one point two billion United States dollars in Series C funding in July 2025 to accelerate phase III trials, with plans to file for U.S. Food and Drug Administration (FDA) priority review by late 2026.

Russia’s entry, developed by the Moscow-based Gamaleya Research Institute (known for its Sputnik V COVID vaccine), takes a hyper-personalized approach. Launched in April 2025, the therapy sequences a patient’s tumor DNA to identify 10–15 unique neoantigens, then crafts a custom mRNA vaccine to trigger an immune response against those specific mutations. Early phase I/II data, published in August 2025, showed a 38% ORR in patients with late-stage colorectal cancer—many of whom had failed standard chemotherapy. A key advantage is the vaccine’s rapid production timeline: Gamaleya’s on-site lab can generate a personalized dose in 14 days, down from the industry average of 21–28 days, using locally sourced lipid nanoparticle (LNP) delivery systems that avoid supply chain bottlenecks. The Russian government has backed the project with fifty million United States dollars in grants to expand production capacity, aiming to treat 5,000 patients annually by 2027.

While both candidates advance, challenges persist. mRNA cancer vaccines require complex manufacturing, and scaling production while maintaining precision remains costly—Everest estimates EVM14 will cost around two hundred thousand United States dollars per patient annually if approved, though it aims to cut this by 40% with larger-scale production. Russia’s personalized model faces hurdles in standardization, as each dose requires unique testing. Regulatory frameworks also lag: the FDA and European Medicines Agency (EMA) are still refining guidelines for personalized mRNA therapies, delaying potential approvals.

Despite these barriers, the 2025 progress signals a turning point. “We’re no longer just proving mRNA works for cancer—we’re showing it can outperform existing treatments,” says Dr. Elena Marchenko, an oncology researcher at the Karolinska Institute. As Everest prepares to expand trials to Europe and Russia looks to partner with German biotech firms for global distribution, the race is not just about speed, but about making these life-saving therapies accessible. For patients worldwide, 2025’s breakthroughs offer a glimpse of a future where cancer treatment is tailored to the unique biology of each tumor—and each person.

(Writer:Lany)